La tua porta d’accesso ai mercati finanziari

Vivi una nuova esperienza di trading con la piattaforma di ultima generazione, completa e veloce.

Su Widiba Trading trovi tutti gli strumenti per operare da sito e da App su oltre 22 mercati mondiali, con un’interfaccia grafica semplice e intuitiva.

Puoi investire su migliaia di Azioni, Obbligazioni e BTP, ETF, CW e Certificates e negoziare in tutte le valute con un profilo commissionale semplice: 0,15% per tutti i mercati.

Vista complessiva dei titoli e rapido inserimento degli ordini

Esplori un'ampia gamma di strumenti finanziari con un motore di ricerca evoluto e hai una vista complessiva dei titoli più scambiati sui principali mercati globali.

Inserisci il tuo ordine in pochi clic e visualizzi il dettaglio sul singolo titolo con informazioni complete, grafici interattivi, news e quotazioni in tempo reale.

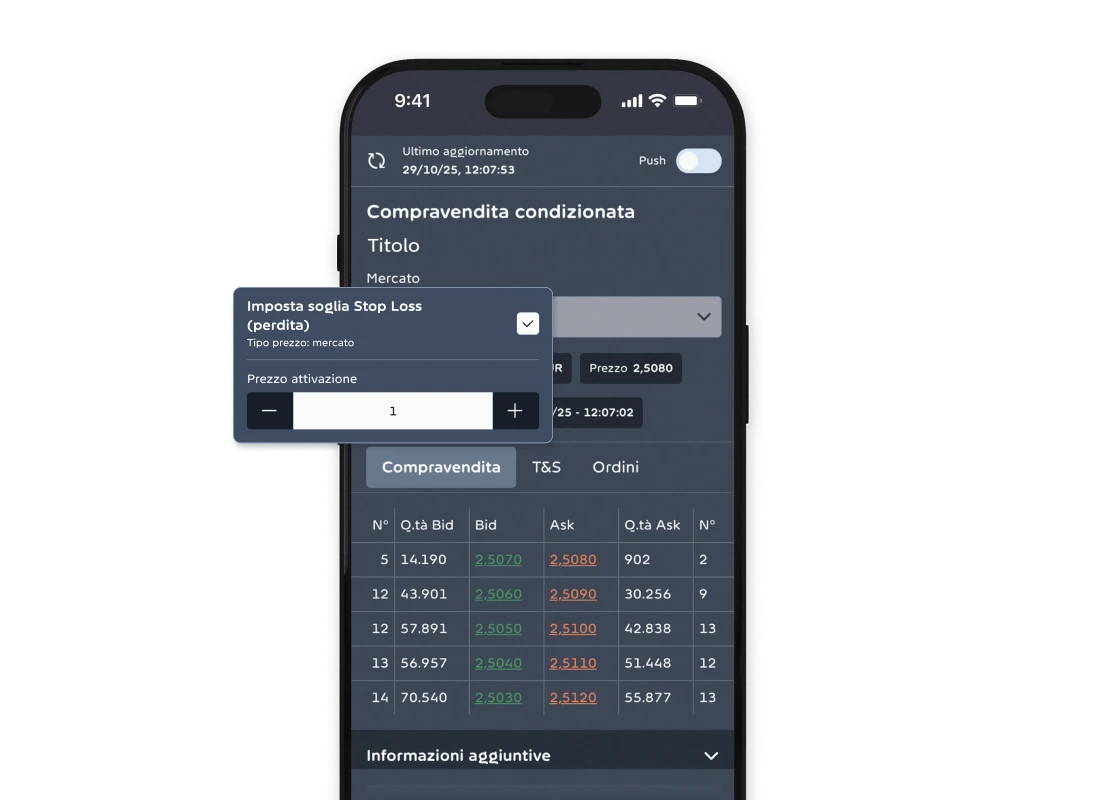

Book a 5 livelli e ordini condizionati

Visualizzi gli ultimi 5 livelli di prezzo degli ordini emessi sul tuo titolo e inserisci il tuo ordine direttamente sulla maschera che trovi all’interno del Book.

News e Alert in tempo reale

Accedi a sezioni di approfondimento sempre aggiornate, consulti i principali dati economici ed esplori nuove opportunità di investimento.

Ricevi notifiche sull’andamento dei tuoi titoli preferiti per reagire tempestivamente ai cambiamenti del mercato.

Non sei ancora cliente di Banca Widiba?

Scopri Conto Widiba Classic

Canone zero per i primi 12 mesi.

Carta di debito internazionale, bonifici SEPA, Deposito Titoli, prelievi di contanti da ATM sopra i 100€ gratuiti e tanti altri servizi inclusi.