Pagare con lo smartphone? È questione di un attimo.

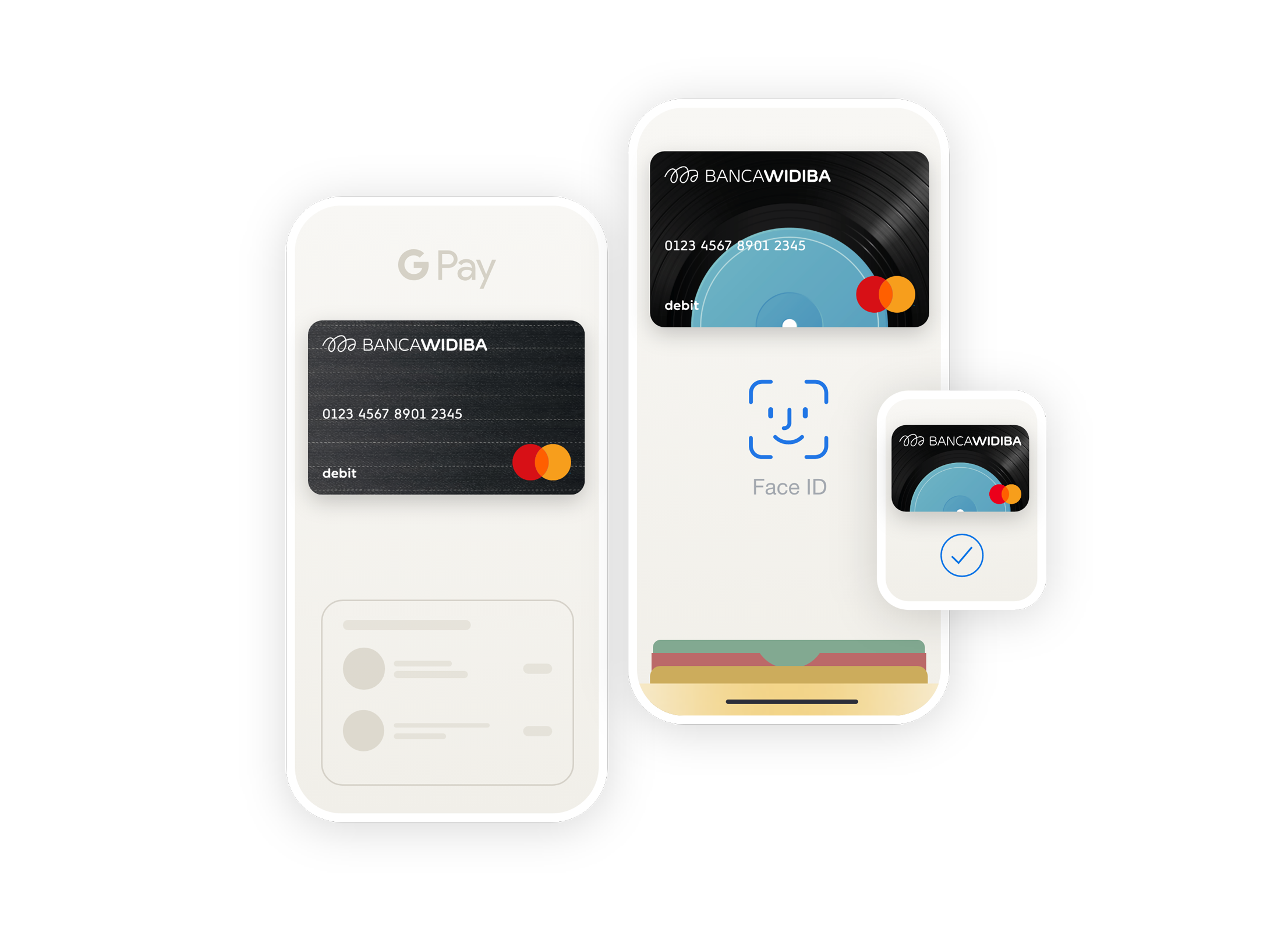

Per un caffè al bar, per entrare in metro o per ogni acquisto quotidiano non hai più bisogno del portafoglio: con Apple Pay e Google Pay ti basta lo smartphone. Associa le tue Carte Widiba ai servizi di pagamento digitale e porta con te solo ciò che conta davvero.

Tre buoni motivi per usare i pagamenti da smartphone:

È facile. L'esperienza d'acquisto nei negozi è più semplice, fluida e immediata.

È sicuro. I tuoi dati di pagamento sono protetti da tecnologie avanzate.

È veloce. Ti basta sbloccare lo smartphone e avvicinarlo a un POS contactless. Pagato.

Potrebbe interessarti anche...

Non sei ancora cliente di Banca Widiba? Scopri Conto Widiba Classic

Canone zero per i primi 12 mesi.

Carta di debito internazionale, bonifici SEPA ordinari e istantanei, Deposito Titoli, prelievi di contante sopra i 100€ gratuiti e tanti altri servizi inclusi.

I pagamenti da smartphone hanno costi?

No, sia Apple Pay che Google Pay sono servizi completamente gratuiti per i clienti Widiba.

Con quali carte posso usare Apple Pay e Google Pay?

Tutte le carte di debito e di credito Widiba sono compatibili sia con Apple Pay che con Google Pay.

Quali dispositivi supportano Google Pay?

Google Pay è compatibile con tutti gli smartphone Android 10.0 o superiori che integrano la tecnologia NFC. Anche in questo caso, puoi controllare la presenza di NFC direttamente nelle Impostazioni del tuo dispositivo.

Con quali dispositivi posso usare Apple Pay?

Puoi utilizzare Apple Pay con qualsiasi dispositivo Apple dotato di iOS 15.6 o versioni successive, purché sia provvisto di tecnologia NFC (Near Field Communication).

Per verificare se il tuo iPhone dispone di NFC, accedi alle Impostazioni e cerca la voce corrispondente.

Per verificare se il tuo iPhone dispone di NFC, accedi alle Impostazioni e cerca la voce corrispondente.